There are a wide variety of approaches and methodologies that can be used in the preparation of development impact fee studies. Impact fees are both a financing and a regulatory tool, and selecting the right approach can be critical to the ultimate acceptance of the study by local citizens, officials and stakeholders. Since each approach can have significantly different effects and implications in terms of revenue potential, incidence (who pays), and resultant urban growth patterns, it is important to carefully select an approach and methodology that best fits local planning goals and objectives. Our firm’s familiarity with the available cafeteria plan of legal methodologies enables us to craft an impact fee system that is tailored to each client’s local needs and desires.

Duncan Associates has drafted over 340 impact fee studies for more than 100 clients in 22 states. The firm has prepared fees studies for all sizes and types of communities from coast to coast. Our clients include the cities of Atlanta, Phoenix, Tucson, Kansas City, Lincoln, Albuquerque, Minneapolis/St. Paul, Las Vegas, and Raleigh; and eight Colorado counties and 12 Florida counties.

Atlanta, Georgia

Roads, Parks, Fire, Police, Water and Wastewater Impact Fee Study

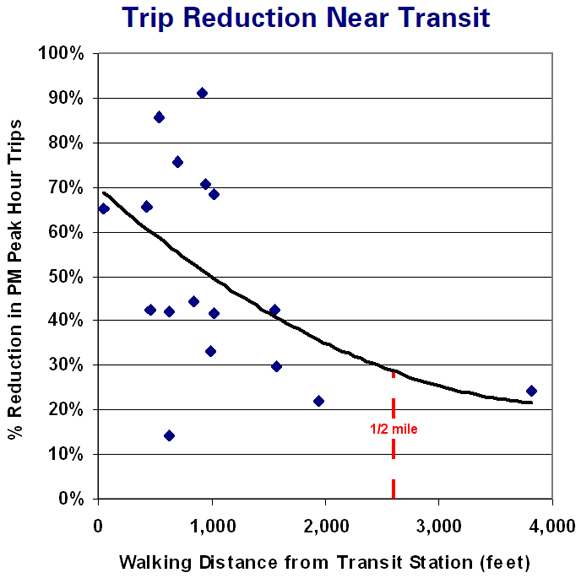

The City of Atlanta houses half a million people and is the economic center of the ninth largest metropolitan area in the country. In 1992, the City retained Duncan Associates to design a multi-facility impact fee system that promoted local growth management objectives relating to affordable housing, economic development and multi-modal transportation. The study calculated impact fees for road, park, fire and police facilities and connection fees for water and wastewater facilities. Throughout the study, every attempt was made to design fees that reflected local characteristics and concerns. For example, development downtown or near MARTA stations was given a significant reduction in road impact fees because of their greater use of transit. Residential fees were based on unit size to promote affordable housing. The City adopted the impact fee program in 1993. Duncan Associates was retained in 2010 to update the City’s fees. By this time, traditional road impact fees were less appropriate, as the City was more built-out and its roadway capital needs focused on complete streets and connectivity rather than new roads and added lanes. In the 2010 update, the road impact fees were converted into multi-modal transportation impact fees, which could be used to make bike and pedestrian improvements not directly related to improvements that expand vehicle capacity.

Santa Fe, New Mexico

Road, Park, Fire, Police, Water and Wastewater Impact Fee Study

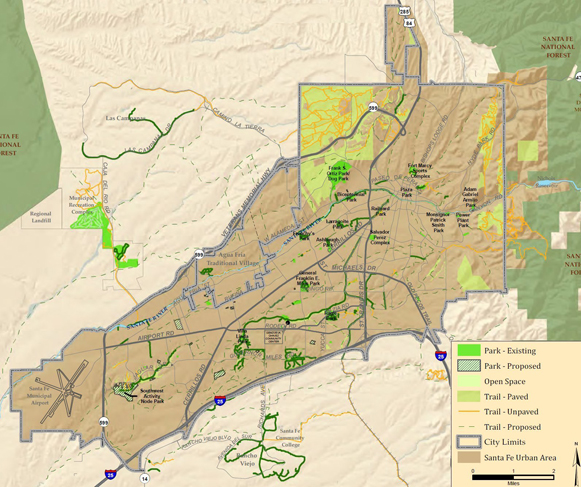

Santa Fe is the capital of New Mexico and the oldest capital city in the United States. Duncan Associates was retained in 2013 to update the City’s transportation, water, wastewater, parks, fire and police impact fees. The firm had prepared the City’s original impact fee study in 2003, and had updated it in 2008. A major focus of the original study was to mitigate negative impacts on housing prices, and all fees were calculated so that fees for single-family units varied by square footage (water fees varied by lot size). The most recent project began with a policy memorandum that laid out methodological and policy alternatives, addressing progressive residential fees, simplification of land use categories, potential service areas and benefit districts, and the efficacy of fee reductions to stimulate development. The City adopted the updated fees in 2014 at 70% of the maximum amounts calculated in the study. This resulted in lower fees for most land use categories, and avoided the need for the City to retain new and old impact fee schedules to comply with State law requirements that fees not be increased for four years following subdivision plat recording.

Lee County, Florida

Roads, Parks, Fire, EMS, Police and School Impact Fees

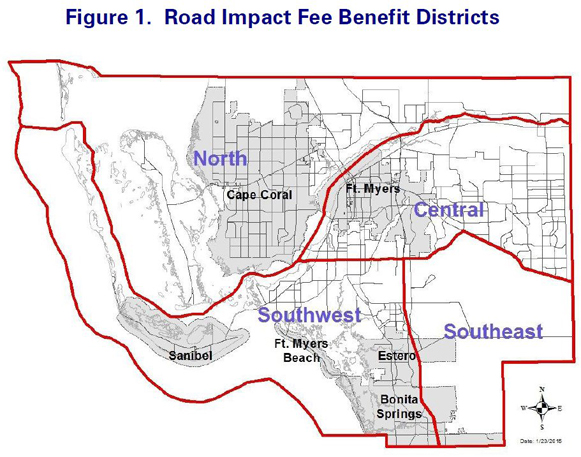

Lee County is a rapidly-growing area in southeast Florida on the Gulf of Mexico. Fort Myers is the county seat, and the county’s population exceeds 600,000. Duncan Associates has been the County’s impact fee consultant since 1999. Our original assignment was to update the County’s fire impact fees, which were calculated separately for each of 19 municipal and independent fire districts. Subsequent assignments included updating the County’s road, EMS, community park and regional park impact fees, and developing a new school impact fee in 2001. The original school impact fee study was litigated and successfully defended, and the defense included the consultant’s expert witness testimony. Duncan Associates has updated all of the County’s fees several times. The most recent update addressed road and school fees. The County had previously reduced all of the impact fees to 20% in response to the downturn in building resulting from the recession. Following the study, the updated road and school fees were adopted at 45% in 2015. In addition, the ordinance was amended to allow the County to spend road impact fees on multi-modal improvements.

Denton, Texas

Water/Wastewater Impact Fee Study

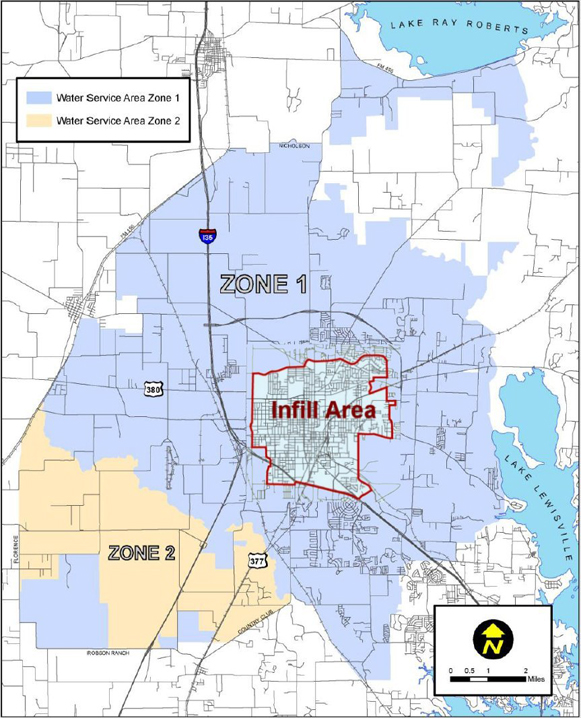

With two major colleges enrolling a combined 45,000 students and a population of over 100,000, Denton is a growing college town on the north end of the Dallas-Fort Worth Metroplex. The City’s water and wastewater utilities assess impact fees on new customers to cover growth-related costs. Duncan Associates has been the City’s impact fee consultant since 2002, completing updates in 2003, 2008 and 2013. The first update made several major changes, including adding line costs, developing a separate wastewater fee for one drainage basin that was planned to be served by a new, smaller treatment plant and a separate collection system, including interest costs, and using calculated revenue credits (as opposed to the alternative method of dividing the fees in half authorized by State law). The updated fees were adopted in 2003. The 2008 update resulted in consolidating the wastewater impact fee service area (plans had changed and anticipated cost differentials had disappeared), and developing a second water service area fee. The 2013 update added a third water service area, corresponding to the City’s adopted special zoning Infill District, where fees were lower due to existing excess capacity.

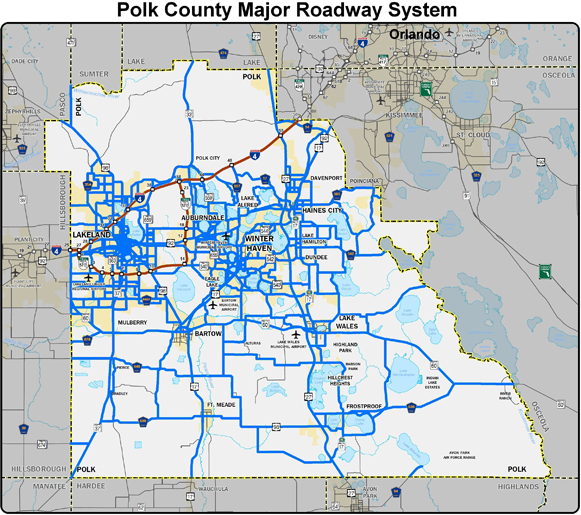

Polk County, Florida

Roads, Parks, Library, Fire, EMS, Law Enforcement, Corrections and School Impact Fees

Polk County is a rapidly-growing suburb of Orlando with a population of over 600,000. Road and school fees are assessed county-wide. In 2010, Duncan Associates, in association with Dr. Nicholas, prepared a study updating all of Polk County’s impact fees, except for roads and schools. While the update retained the basic methodology of basing fees on the existing level of service and using call data for public safety facilities, several changes were made to methodologies used to calculate fees. Calculations were simplified for greater transparency and credit was provided for outstanding debt on existing facilities. The County subsequently updated the six fees based on the study. The firm was retained in 2014 to update all fees, including roads and schools. The road fee update reduced land use categories for greater ease of administration, and included multi-modal components. Road and park service areas were modified. At the direction of the County, alternative fees were calculated that excluded State roads and community parks. The County adopted updated fees based on the study in 2015.

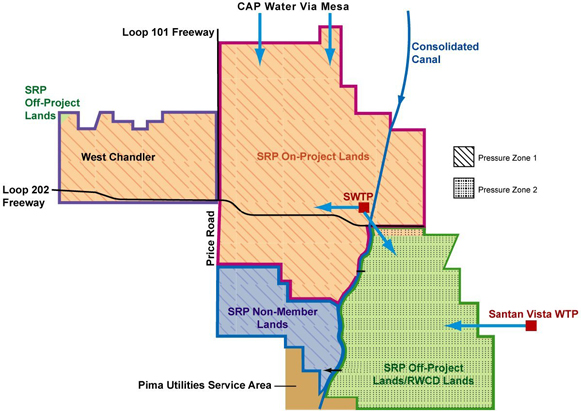

City of Chandler, Arizona

System Development Fee Study for Streets, Water, Wastewater, Parks, Fire, Police, Libraries, and Public Buildings

Duncan Associates updated the City’s system development fees in 2008 and 2014. In the 2008 update, fees were based on existing level of service or build-out cost per service unit, whichever was lower. In the 2014 update, fees were based on the lowest of existing level of service, ten-year cost per service unit or build out cost per service unit. The addition of a ten-year analysis in 2014 was necessary to ensure compliance with new state law requirement that the infrastructure improvements plan not cover more than ten years. A major change to the street methodology was to adjust service unit multipliers to take into account pass-by trips and average trip lengths associated with retail and office land uses. Previous multipliers were based solely on peak hour trip generation rates. This change resulted in significant reductions in retail and office arterial street fees. In the 2014 update, water supply and distribution fees, were combined into one fee, as was wastewater treatment and collection.

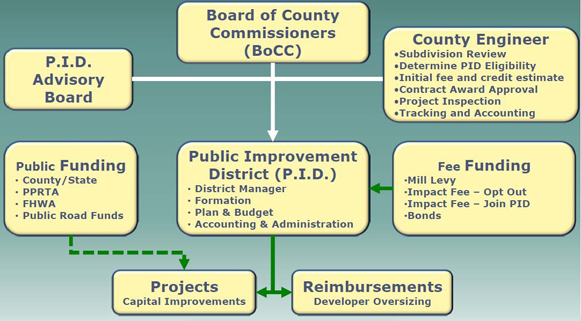

El Paso County, Colorado

Road Impact Fee/Public Improvement District

Home to Colorado Springs and the U.S. Air Force Academy, El Paso County is the second most populous county in Colorado, with over 600,000 residents. Duncan Associates assisted the County in working with the local development community to create a unique funding program for major road improvements. The new funding system was a hybrid of a road impact fees and a public improvement district. The unincorporated portion of El Paso County had been subject to an interim road impact fee since 2010. The interim fee replaced several small-area fee programs that had been negotiated with major developers. At the time of the adoption of the interim fee, the Housing and Building Association of Colorado Springs (HBA) and other stakeholders expressed support for the establishment of a county-wide fee system, as opposed to small-area fee programs, and agreed to work with El Paso County to develop a county-wide system for fees, credits and reimbursements. County staff and consultant worked with a small group of stakeholders, primarily representing major developers, to craft the system. Major developers saw impact fees as helping to level the playing field and providing prompter reimbursement for their improvements. Developers who elect to join a public improvement district pay lower up-front fees and are eligible for reimbursements from PID bonds. County Commissioners adopted the program in 2012. The project received an award from the Colorado chapter of the American Public Works Association.

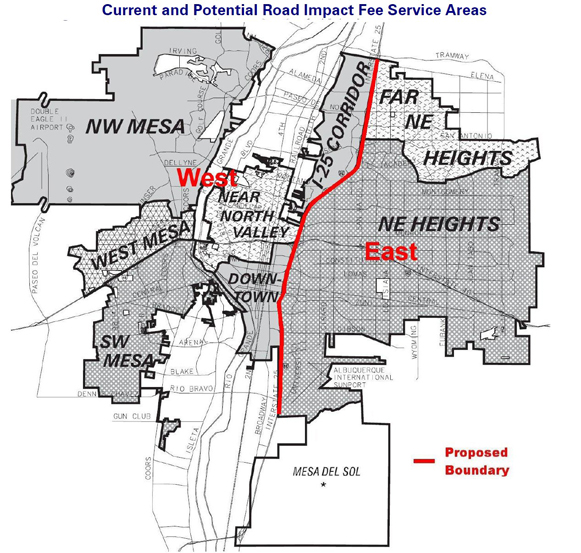

Albuquerque, New Mexico

Road, Drainage, Park, and Public Safety Impact Fee Study

Albuquerque, with a population of over half a million, is the largest city in New Mexico. The City had adopted impact fees in 2004, and had reduced them to 50% of the maximum amounts in 2009 in response to the recession. The fee system, prepared by another consultant, was very complex, with different service areas for the various fees, resulting in 17 different fee schedules applicable to different areas of the city. In addition to being difficult to administer, it had pitted areas of the city against each other, with residents in high-fee areas believing that the fees were barriers to employment and retail growth. In 2011, the City retained Duncan Associates to update its road, drainage, park, fire and police impact fees. The project was divided into two phases: policy directions and implementation. In the first phase, the firm prepared a policy memorandum that analyzed the current system and recommended changes. The recommendations focused on simplification. The methodologies used by the previous consultant to calculate significantly different fees by area were found to be based more on revenue credits driven by policy rather than on demonstrable cost differentials. The firm recommended consolidating service areas and charging uniform city-wide fees. The City Council adopted the updated fees in 2012, although with an extended phase-in period.

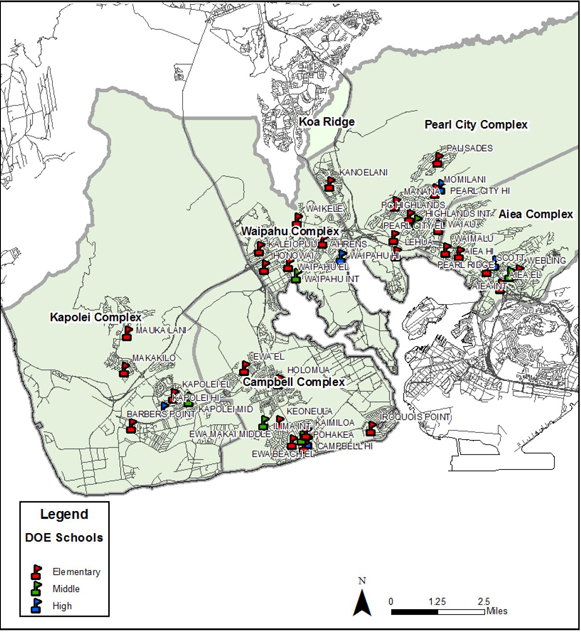

State of Hawaii

School Impact Fee Legislation and Studies

For the State of Hawaii, Duncan Associates, in association with Oahu-based Group 70 International, assisted in the development of three separate school impact fee projects. The first was contracted in 1999 with the Department of Education, to help them respond to developers who were concerned that DOE lacked the expertise or objectivity to establish a reasonable “fair share contribution.” The Department subsequently used that study in negotiations with developers who required a change in land use designation from the State Land Use Commission. In 2006, we were retained by the State Auditor’s Office to assist a Working Group established by the legislature to recommend possible changes to state law to create a fair system of developer dedications and contributions for schools. A key finding of the study was that the state-wide decline in school enrollment made it difficult to justify state-wide school impact fees. We assisted in drafting legislation that was the basis for Act 245, which was passed in July 2007 and established the basis for DOE to establish “school impact districts” in which enrollment growth was occurring and developers would be required to dedicate land or pay fees in-lieu of dedication and to pay impact fees for school construction costs. In 2008, the firm was retained to help identify school impact districts across the state. Subsequently, DOE enacted school impact fees in several high-growth areas.

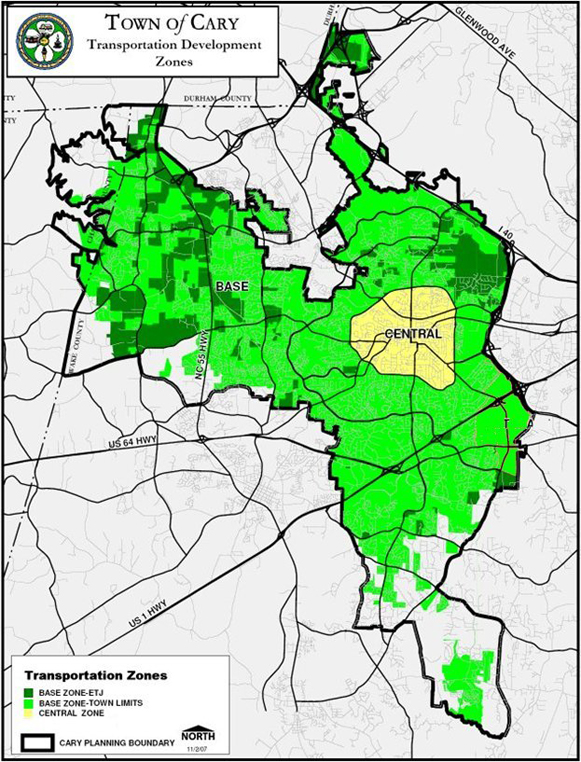

Cary, North Carolina

Transportation Development Fee Study

The Town of Cary, located in the Raleigh-Durham-Chapel Hill Research Triangle, is one of the fastest growing municipalities in the nation. In the late 1980s, Duncan Associates developed a city-wide, consumption-based transportation development fee (TDF) for the Town. One of the unique features of the fee was the exclusion of the cost of collector road improvements, which were the responsibility of the adjacent landowner – this allowed the Town to continue its policy of frontage requirements without providing credit against the fees. In 2003, the firm was retained to assist in the development of a zonal, improvements-based TDF program. The update was undertaken in conjunction with the development of a long-range transportation plan by Wilbur Smith Associates. Based on select-link analysis performed under our direction, the planned costs were allocated among and between geographic areas. In addition to the “downtown” area defined by an inner loop road, the Town identified other areas with high development potential and expensive improvements needed to accommodate growth. The updated fees were adopted by the Town, concurrent with amendments to the adequate public facilities (APF) ordinance. The Town-wide fee was assessed on all new development in the Town. The zonal fees, however, were not assessed in the downtown zone in order to encourage infill and redevelopment in this area. During the 2007 update, the fee system was simplified, and fees in the downtown core were reduced based on the lower level of service standard required in the area by the APF ordinance. The firm completed an update in 2015.